Introduction

In cutting-edge ever-exchanging financial panorama, owners steadily in finding themselves in precarious instances where securing a personal loan seems essentially unimaginable, noticeably if they have negative credits. However, the coolest information is that there are options achieveable that mean you can free up your property's knowledge regardless of much less-than-highest quality credit ratings. This complete assist will walk you by way Frequent Finance Latest News of the job of obtaining secured loans or property owner loans tailor-made for men and women managing undesirable credit score. We'll delve into how direct lenders can furnish you with a feasible pathway to fiscal stability and assistance you observe your dreams.

Unlocking Your Home's Potential: How to Secure a Confident Loan with Bad Credit by means of Direct Lenders

When it comes to financing, many employees are unaware of the more than a few personal loan merchandise on hand primarily designed for those going through credit score challenges. By information what secured loans or property owner loans entail, and the way direct creditors perform, you'll be greater fitted to make proficient decisions.

What Are Secured Loans?

Secured loans are types of borrowing wherein the borrower can provide collateral against the amount lent. Commonly, this collateral is oftentimes in the sort of authentic property or confidential assets. Because those loans are sponsored by means of constructive assets, creditors view them as scale back possibility in contrast to unsecured loans.

Key Features of Secured Loans

- Collateral Requirement: The borrower would have to positioned up an asset. Lower Interest Rates: Due to decrease probability for creditors. Higher Borrowing Limits: Access to better sums of payment. Longer Repayment Terms: Flexibility in repayment intervals.

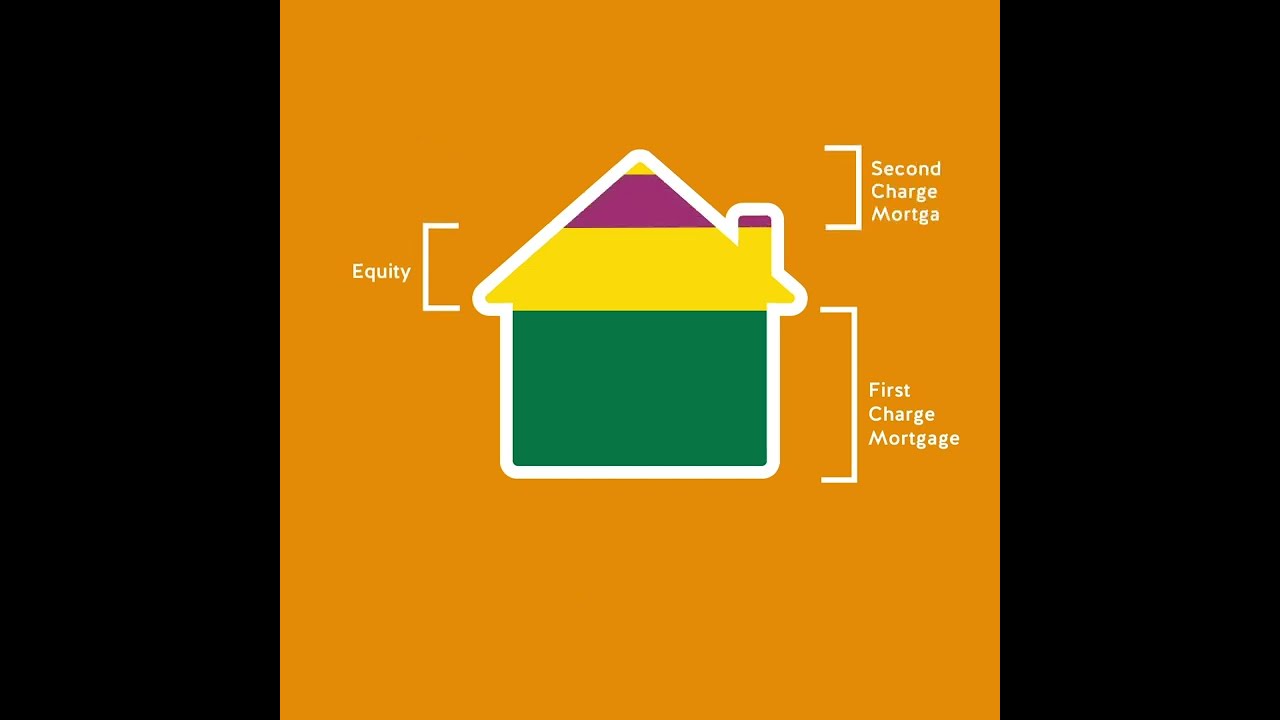

Understanding Homeowner Loans

Homeowner loans, pretty much classified as secured loans, allow property owners to borrow opposed to the equity they have got constructed in their belongings. This kind of personal loan shall be namely marvelous for these seeking to finance most important expenses like abode renovations or debt consolidation.

Types of Homeowner Loans

Home Equity Loans: A lump sum borrowed in opposition to home fairness. Home Equity Lines of Credit (HELOC): A revolving line of credits depending on domicile equity. Cash-Out Refinancing: Replacing your existing personal loan with a brand new one for greater than you owe.The Challenges of Bad Credit Loans

Bad credits can ceaselessly sense like an insurmountable barrier whilst in the hunt for a personal loan. However, bad credit score loans are in particular designed for individuals who might also have had beyond financial difficulties but still require funding.

Characteristics of Bad Credit Loans

- Higher pastime prices due to the perceived risk. Shorter compensation periods. Possibility of better prices and penalties.

Why Choose Direct Lenders?

Direct creditors supply a variety of advantages over basic banks and financial associations. They can furnish faster processing instances and more custom-made services and products tailor-made to uncommon wishes.

Benefits of Working with Direct Lenders

Faster Approval Processes: Many present immediately determination lending. Flexible Terms: Tailored repayment plans structured on exotic cases. No Credit Check Options: Some direct creditors be offering terrible credits loans without good sized credit score tests.Finding Instant Decision Lenders

If time is of the essence, looking for on the spot determination creditors can expedite your borrowing technique significantly. These lenders make use of science and streamlined processes to supply short approvals—typically within hours!

How Instant Decision Lending Works

Online utility submission Automated assessment algorithms Immediate remarks involving approval statusExploring No Credit Check Lenders

For contributors nervous about their credits history impacting their capability to shield a personal loan, no credit score test creditors might also provide relief and chances with no delving into your previous financial blunders.

Pros and Cons of No Credit Check Loans

| Pros | Cons | |------|------| | Quick get right of entry to to payments | Higher attention prices | | Less stringent qualification standards | Risky if not able to repay | | Ideal for emergencies | May incur added expenses |

The Application Process Simplified

Applying for a secured personal loan or property owner mortgage comes to countless steps which may appear daunting originally glance but are especially uncomplicated once broken down.

Step-by way of-Step Application Guide

Assess your existing financial predicament—comprehend your credit score ranking and terrific money owed. Research prospective creditors specializing in individuals who specialize in awful credit score loans. Prepare essential documentation—proof of source of revenue, id, asset recordsdata. Submit your application on line or in man or woman stylish on lender personal tastes. Await approval and be prepared for you can questions from the lender.What Documentation Do You Need?

Having all integral records in a position earlier using can streamline the strategy vastly and prevent frustration at bay.

Essential Documents Include

- Proof of identification (e.g., driver's license) Recent pay stubs or tax returns Bank statements Details about any collateral offered

Understanding Interest Rates for Bad Credit Loans

Interest premiums on poor credit loans tend to differ widely depending on a couple of aspects consisting of lender guidelines and industry circumstances.

Factors Influencing Interest Rates

Borrower’s creditworthiness Amount being borrowed Length of the mortgage term Type of collateral offeredStrategies for Improving Your Chances

While securing a mortgage with negative credit score is difficult, loads of innovations can increase your probability of approval from direct lenders.

Tips Include:

Improve your common fiscal wellbeing and fitness sooner than applying—pay off small debts if conceivable. Offer sizeable collateral—this will help negotiate bigger phrases. Consider having a co-signer—a person with more advantageous credit score may well bolster your program.Potential Pitfalls When Seeking Bad Credit Loans

Navigating the sector of secured loans requires caution as assured pitfalls may lead you into negative agreements.

Common Mistakes To Avoid

- Overlooking hidden expenditures associated with loans. Not comparing varied gives from extraordinary creditors. Ignoring fantastic print tips regarding reimbursement phrases.

FAQs About Securing Loans with Bad Credit

Here are a few recurrently asked questions touching on undesirable credit loans:

1) Can I get a secured loan if I actually have awful credit?

Yes! Secured loans are in most cases achieveable even if you happen to possess poor credits because they contain collateral that reduces the lender’s hazard.

2) What sorts of collateral do I need?

Common types include properties, cars, or different invaluable resources that continue remarkable value relative to the mortgage volume requested.

3) Will my interest fee be larger?

Typically yes, given that lenders view borrowers with undesirable credit as higher-threat users; but, offering strong collateral would possibly help mitigate this increase a bit.

4) How lengthy does it take to get approved?

Approval times can differ commonly with the aid of lender yet opting for immediate selection lenders in general expedites this process appreciably—frequently inside hours!

five) What should I appear out for in terms?

It’s a must have to study all phrases competently adding curiosity charges, hidden charges worried in addition to settlement schedules until now committing yourself financially!

6) Is it sensible to make use of my abode as collateral?

This depends on confidential occasions; at the same time it can unencumber finances necessary urgently evaluate conceivable risks linked to risking shedding one’s most important place of abode if repayments defaulted!

Conclusion

Securing a certain mortgage even when faced with unhealthy credits is possible through understanding categories achieveable including secured loans or home-owner alternate options furnished especially through direct lenders specializing during this arena! By arming your self with wisdom approximately what those merchandise entail coupled along realistic software thoughts indexed above make certain navigating this path leads closer to unlocking no longer just financial chances but higher peace-of-mind regarding funds universal too! Always recall that even with setbacks observed along lifestyles’s ride—there exists wish in advance ready simply around corner when in quest of advice tailored in particular against specified scenarios faced on daily basis!

This article serves as a comprehensive aid aimed at demystifying the complexities surrounding securing poor credits loans although showcasing services in the course of diverse aspects discussed herein in a roundabout way empowering readers against making expert decisions transferring ahead!